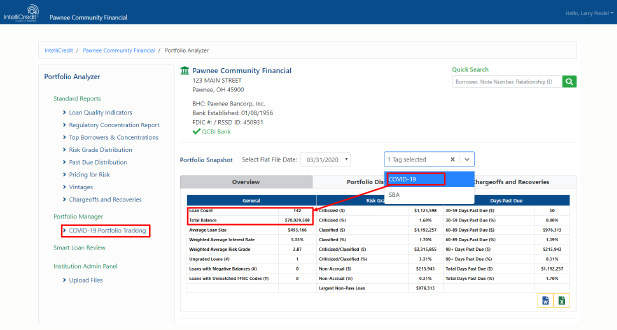

COVID-19

Loan Tracker

Online tool helps you track, manage and report potential credit issues and losses.

Online tool helps you track, manage and report potential credit issues and losses.

While Interagency Guidance provides temporary accounting relief for COVID-19 affected loans, these loans remain a hotbed for future, potential credit issues and losses.

Regulatory reporting on these loans will be REQUIRED. Financial institutions must be vigilant in tracking COVID-19-affected loans quantitatively, but also managing these loans qualitatively.

Rely on our expertise. We are former lenders and credit experts at our core – staying on top of regulatory requirements and keeping you (and the COVID-19 Loan Tracker) updated.

It's easy to get started. We work with all core systems and do the heavy lifting for you.

Fill out the form, and we’ll schedule a quick demo.

All fields required.

Thank you for your request!

One of our specialists will be in touch soon to assist you.