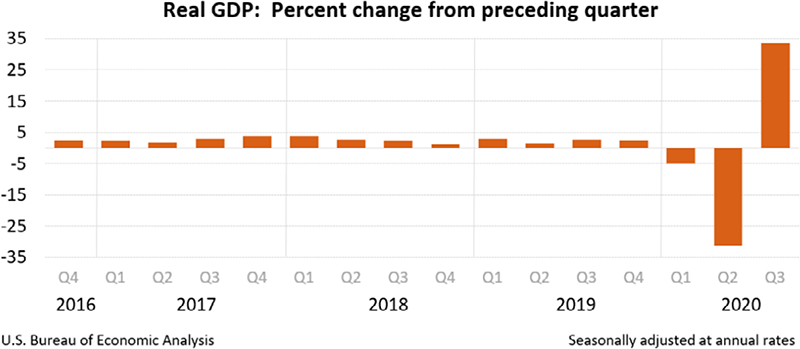

In the second quarter of 2020, the U. S. Gross Domestic Product plunged to an annualized pace of 32.9%, the steepest drop since the 1940s. This unprecedented dive was followed in the third quarter by a 33.1% annualized increase. Remember, after the 2nd quarter drop it would take an annualized gain of over 49% to get us back to even. The upturn in real GDP reflected rises in personal consumption expenditures (PCE), private inventory investment, exports, nonresidential fixed investment, and residential fixed investment. Offsetting the GDP growth were decreases in federal government spending due to reductions in administration fees received for Paycheck Protection Program (PPP) loans, as well as reductions in spending by state and local governments. There is still more work to be done.

The economy is now continuing its K-shaped recovery, which is characterized by an overall unemployment rate that is falling, while the number of people unemployed for longer than 27 weeks is increasing. These trends continued in November. That month 245,000 new jobs were added, but the economy still remains shy of 9 million jobs needed to bring employment back to pre-pandemic levels. Based on November’s rate of employment, we will face at least a 40-month climb before reaching the heights achieved prior to COVID.

What is particularly concerning is the fact that employment was slowing dramatically even after September, when the economy created 661,000 jobs and a recovery time of 1.5 years seemed likely. Employment momentum has dwindled and will probably continue to lag in December. Meanwhile, the K-shaped recovery continues to favor Wall Street over Main Street and larger/well-capitalized businesses over small businesses. The next few months look to be devastating for many small businesses. The recovery also affects those who invest in the stock market more positively than those who do not.

Finally, it’s obvious, but should be noted, that the remote economy benefits people who are able to do their jobs from home over people who must go to a workplace. And any business that requires people to gather in one location will continue to struggle over the winter months.

Presently, ongoing and contrasting signals point to one reality: our economy will not fully recover until more fiscal support is provided and we contain/control COVID-19. Because when a Main Street business closes, a Wall Street business likely wins. Vaccines will obviously help, but a return to “normal” does not likely occur until late summer/early fall of this year. This means banks will need to pay active and diligent attention to their credit portfolios.

Preparing for the inevitable—whatever it may be

We believe that, given these circumstances, it is increasingly likely that your next exam will dive more deeply into the bank’s loan reviews and other areas of risk management. Additionally, we suggest that an accompanying portfolio stress test could be a strong complement to any loan review.

The purposes and benefits of credit stress testing

While never a substitute for strong loan underwriting and grading, stress testing can help banks evaluate lending risks and gauge capital adequacy requirements resulting from stressed conditions. Regulators confirm that this exercise in plausible foresight can be an effective risk management strategy. “Experience from bank examinations suggests that community banks that proactively manage their lending function and attempt to plan for, measure and control their vulnerability to adverse events have been better able to make adjustments and improve performance over time.” (FDIC Supervisory Insights, Summer 2012).

Banks can create a variety of stress tests to evaluate their credit risk and its probable impact on their capital. One of the primary objectives of a credit stress test is to learn what would be the effect on your capital if we should enter a period of stress. What type(s) of losses you might incur and their consequences for your bank? This is what you should want to know, and it is exactly what regulators want to know.

Stress test methods that meet a variety of needs

There are numerous, effective ways to conduct a credit stress test. These are five of the best approaches, each one with characteristics to recommend it.

- Stressed Portfolio Loss Rates: This stress testing method applies a set of portfolio loss rates that might occur with an expected downturn in economic conditions. The analysis can help banks identify the extent to which capital might be at risk in that particular event, given the bank’s balance sheet structure and loan mix.

- Reverse Stress Testing: To perform this type of stress test, the bank first assumes a known adverse outcome — for example, severe credit losses that reduce capital levels below internal targets or preferred regulatory thresholds. This analysis helps banks identify/quantify the earnings and capital buffer needed to absorb such losses.

- Scenario Analysis: Evaluating how a specific portfolio might react if certain changes occur. The variables might be based on an adverse historical occurrence the bank had experienced before, or on a hypothetical situation (such as the possible closing of a nearby manufacturing plant), or, in the case of a stylized scenario, a drop in one of the bank’s key performance metrics.

- Loan Migration Analysis: By capturing internal data, banks with larger portfolios can evaluate how a downward migration in internal loan ratings would affect their asset quality and capital. This type of analysis may also assist bank credit teams in developing faster responses to any potential migrations or deteriorations in their portfolio.

- Transactional Sensitivity Analysis: Prior to making a credit decision, a bank can analyze available financial and market assumptions and measure the effects of possible changes in those assumptions. This analysis helps banks determine the degree by which cash flows or collateral values might change and gauge the borrower’s ability to withstand or absorb any adverse fluctuations.

There is not one perfect way to approach stress testing. However, it’s easy to see that the methods described here will provide you and your bank better information with which to manage your credit portfolio. While some tests are easier than others to incorporate, all will contribute value to your overall risk management process.

Final thoughts

Ironically, the strategic benefits of stress testing might be greatest during better economic times, when credit losses are

minimal. However, as we move into a more challenging economic period, knowing how your portfolio might be moving and

how your portfolio performed during the last crisis will be an important first step as banks focus on minimizing losses this

time around.

David Ruffin (david.ruffin@intellicredit.com) is principal of IntelliCredit and was instrumental in developing its innovative credit risk management solution, which makes it efficient and affordable for banks of all sizes to proactively manage fluctuating credit risk, fuel game-changing mandatory loan reviews, and curtail credit losses.

For more information on IntelliCredit, visit intellicredit.com or email info@intellicredit.com.